NDTV late on Wednesday said the income tax department in 2017 provisionally barred the networks founders - Prannoy and Radhika Roy - from selling a part of their stake as part of a reassessment of their taxesBut Adani said on Thursday no such approval was required and that the founders tried to further inordinately delay the deal. Applicability of GST on payments in the nature of liquidated damage compensation penalty cancellation charges late payment surcharge etc.

Can Electronic Credit Ledger Be Used For Pre Deposit Payment Under Gst

That is a total of 639 days which is less than.

. The date on which the recipient entered the payment in his books. Maximum late fee is reduced. 01 Sep 2022 0750 PM IST.

Prior to the enactment of US tax reform legislation on December 22 2017 the Act a non-US corporation engaged in a US trade or business was taxed at a 35 US corporate tax rate on income from US sources effectively connected with that business ECI. Late filing attracts penalty called late fee. For June 2021onwards in case of monthly filers and quarter-ended June 2021 onwards for QRMP taxpayers.

Show more Show less. However VAT deduction must be exercised under the. Small bar and gold coin S2 per piece per day.

Get 247 customer support help when you place a homework help service order with us. INR5000 if the return is furnished on or before 31 December If the total income of the person does not exceed INR500000 the fee payable for late filing of India Tax Return shall not exceed INR 1000. Shweta left for the United States in 2001.

As you may well know there are several ways to pay your annual car insurance premiums such as auto-debit online payments as well as the traditional payment options like cheques and cash. List of services on which GST is payable on reverse charge. She has been in India from June 30 th 2017 to March 31 st 2019.

The Maharashtra legislature enacted a bill on Monday March 21 2022 to provide for the payment of tax interest penalty and late fee arrears that were due under Acts previous to the implementation of the Goods and Services Tax GST. She returned to India on June 30 th 2017. Female employees who are covered under the.

But you also have the option to pay it in installments. She will be considered as an RNOR for the financial year April 2017-March 2018. The Act permanently reduced the 35 corporate.

Purchasing tax from the tax pool will help save up to 30 use of money interest and 100 on late payment penalties. Reduced Late fee 42018. 18 per annum 15 per month that commences from the first day of the following month after the contributions are due.

So it is 100 under CGST 100 under SGST. A fine of up to 10000 with no less than 2000 per offence andor 12 months jail. For nil filers it is fixed at Rs500 per return.

Deadline for submission of the relevant VAT return. 100 per day per Act. The rate of penalty is 50 per cent of tax for under-reporting.

For the purpose of computation of Date of Supply the Date of Payment shall be earlier of the following-The date on which the payment is debited from his bank account or. Melayu Malay 简体中文 Chinese Simplified Guide to Imported Services for Service Tax Guide on Imported Taxable Services. With effective from 1 January 2019 imported taxable service is subjected to service taxIn accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service acquired by any person in.

Overtime payment period if difference from item 7. Further where a person fails to file India Tax Return within the time prescribed late filing fees shall be charged as follow. This will assist the state in generating significant revenue.

Kilobar S5 per kg per day. The late fee is Rs. Arising out of breach of contract or otherwise and scope of the entry at para 5 e of Schedule II of Central Goods and Services Tax Act 2017 hereinafter referred to as CGST Act in this context has been examined in the.

For the rest it is fixed as per turnover slabs. However the Act significantly revised the federal tax regime. Union Budget Update - Highest GST collection in the.

Link to Notification. This means that both married and unmarried mothers will be entitled to 16 weeks of maternity leave subject to the conditions under the CDCA. The 16 weeks statutory maternity leave benefit under the CDCA is extended to unmarried mothers from early 2017.

There will be a late collection charge thereafter. In practice a taxpayer that purchased and paid for a service in December 2017 and receives the invoice dated December 2017 in January 2018 can exercise the right of deduction only from the VAT settlement related to January 2018 and by 30 April 2019 ie. Of the highest gold balance each month subject to a monthly minimum charge of 012 grams of gold.

July 2017 onwards. Applicability of Late fee. Purchased tax needs to be transferred to IRD within 75 days of the terminal tax due date.

Additions to Tax Reasonable Cause Exception A taxpayer can challenge his or her underlying liability including additions to tax under sections 6651a1 and 2 if the taxpayer has had no prior opportunity to dispute the underlying liability. If any of the offenses are committed then a penalty will have to be paid under GST. If you have missed or underpaid a tax payment you can use Tax Pooling Solutions to buy this back dated tax.

A fine of up to 10000 imprisonment of up to 7. Total will be Rs. Some credit cards allow you to convert your car insurance premium payment to 0 Easy Payment Plan.

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. The principles on which these penalties are based are also mentioned by law. Let us make this simple with an example.

A fine of up to 5000 with no less than 1000 per offence andor up to 6 months jail. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The service charge is calculated on a monthly basis at 025 pa.

This post is also available in. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

An Overview Of Gst Letter Of Undertaking Lut Enterslice

How To Calculate Late Fees And Interest On Gst Returns Eztax

Manner Of Tax Payment Under Gst

Gst Return Late Fees Interest On Gstr Late Payment

Higher Gst For Supplements In India Will Hit Consumer Health And Market Expansion

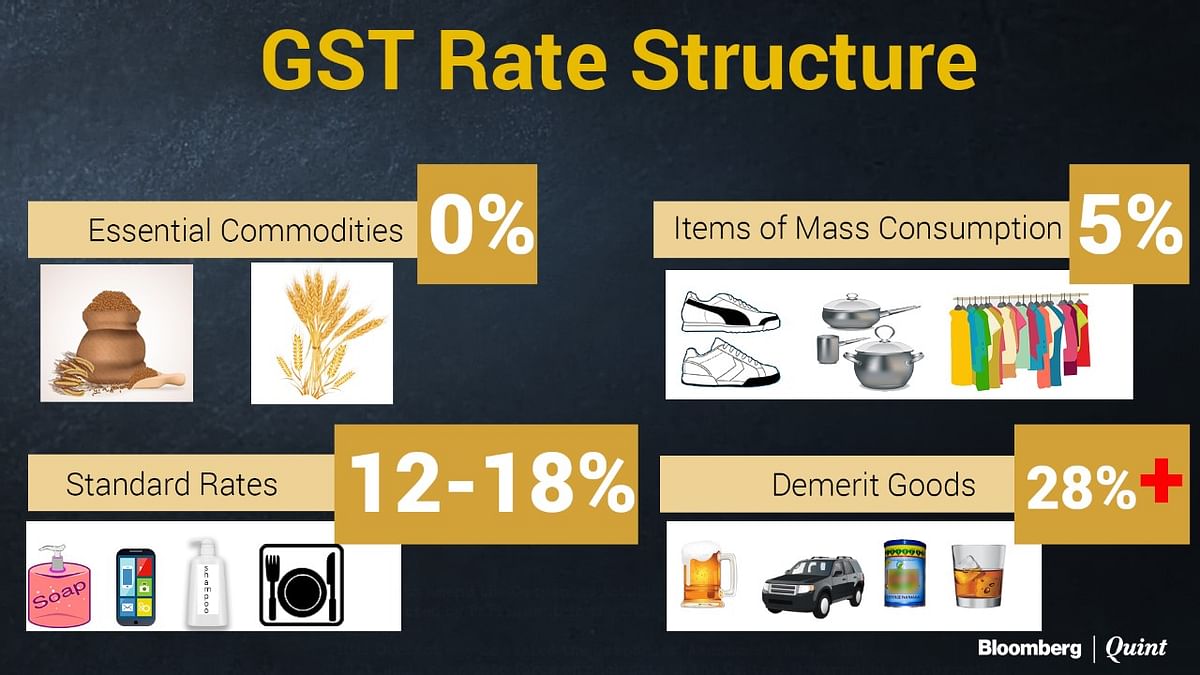

India Gst The Four Tier Tax Structure Of Gst

How To Do Gstr 3b Itc Set Off Correctly I Gst Portal Showing Wrong Adjustment Ca Satbir Singh Youtube

Compliance Automation Needed For Gst Forms

The Gst In India Tax Rates Slashed Some Compliance Relaxed India Briefing News

Five Key Trends Managing Vat Gst Evolution Across Asia Pacific International Tax Review

Consequences Of Non Filing Of Gst Returns Enterslice

Gst Return Is Not Filed What Happens Then Incorp Advisory

Notice From Gst Department Top Reasons Response Timing Eztax In Accounting Tax Services Accounting Software

How To Calculate Late Fees And Interest On Gst Returns Eztax

Gst Teething Issues Still Haunting Msmes

21 Offenses Penalties And Appeals In Gst How To Safeguard Yourself

Casio G Shock Gst B100 1ajf Analog 1032 Ebay